INCORPORATION

Incorporation Types: LLC, S Corp, C Corp, Non Profit

We make it fast, easy and affordable.

SERVICES

ANALYTICS AUDIT

CRM | CUSTOMER RELATIONSHIP MANAGEMENT

CONSULTING

COPYWRITING

DIGITAL MARKETING

DOMAIN NAMES

E-COMMERCE

E-MAIL MARKETING

FACEBOOK ADVERTISING

GOOGLE ADS | SEM

GRAPHIC DESIGN

INCORPORATION

INFORMATION TECHNOLOGY

INSTAGRAM ADVERTISING

LANDING PAGES

LOGO DESIGN

PHONE SYSTEMS

PHOTOGRAPHY

PUBLIC RELATIONS

SEO AUDIT

SOCIAL MEDIA AUDIT

STARUP BUSINESS SERVICES

VIDEO PRODUCTION

WEB DESIGN

WEBSITE MAINTENANCE

You want to communicate a consistent message to your customers through email on a regular basis, but you don’t know how to create a campaign or template, let alone send email blasts. You want to grow your customer list automatically, ensure retention and build credibility. You also may not have the staff, time or expertise to handle the full extent of your email marketing needs. You also want to track the campaign’s results so you can optimize your offerings and messages.

ANY HICCUP CAN COST CONVERSIONS

SOME TECHNICAL DETAILS

Can you think of a time during which it’s more critical to have your website working perfectly than when a customer decides to add a product to his or her cart? From that moment on, it’s vital that not only the site functions flawlessly but also that the user is intuitively guided throughout the checkout process. Studies have shown that the speed, responsiveness, and usability of an e-commerce site directly affect conversion rates and customer retention. During the research and planning phase, we take the buying cycle and user flow under careful consideration—as well as the client’s everyday admin needs. As a result, we build focused, informed, secure shopping experiences that make it easy for customers to shop and purchase—and easy for admins to ship and manage anywhere from three products to three million.

We use Squarespace to power the online shops we build due to its seamless integrations and user-friendly interface. We adhere to PCI compliance regarding security and facilitate other measures beyond PCI compliance.

We are experienced and extremely comfortable integrating:

CREATE AND SELL CUSTOM PRODUCTS ONLINE

Easy print-on-demand drop shipping and fulfillment warehouse service. Free signup • No order minimums • 160+ products

Payment Gateways

Variable sales tax

Inventory and third-party tracking

Product variations

Pricing models

Dynamic shipping and tracking via UPS, FedEx, or USPS

CUSTOMER RELATIONSHIP MANAGEMENT

DIGITAL MARKETING

SBP will establish a multi-dimensional marketing strategy that will drive more traffic.

WEB DESIGN

A website-revamp may be an action-item after your audit.

CONSULTING

We’ll help you think more critically about your business, boost growth and operate more efficiently.

DIGITAL MARKETING

Make Email Marketing a part of your digital marketing services package.

FACEBOOK ADVERTISING

Make Email Marketing a part of your digital marketing services package.

CUSTOMER RELATIONSHIP MANAGEMENT

LANDING PAGE DESIGN

Attract a specific audience and deliver a personalized experience for all your campaigns.

SERVICES

ADVANTAGES OF INCORPORATING

• Owners are protected from personal liability fro company debts and obligations.

• Corporations have a reliable body of legal precedent to guide owners and managers.

• Corporations are the best vehicle for eventual public companies.

• Corporations can more easily raise capital through the sale of securities.

• Corporations can easily transfer ownership through the transfer of securities.

• Corporations can have an unlimited life.

• Corporations can create tax benefits under certain circumstances, but note that C corporations may be subject to “double taxation” on profits. To avoid this, many business owners elect to operate their corporations under subchapter S of the Internal Code. Also known as an S corporation, this entity allows income to pass through to the individual shareholders.

UNDERSTANDING CORPORATION TYPES

FILING A DBA

LIMITED LIABILITY COMPANY (LLC)

A DBA filing (doing business as, also called an assumed or fictitious business name) allows a company to transact business using a different name. It generally takes place at the county level, but some states have state-level DBA filings. For sole proprietorships and general partnerships, unless a DBA is filed, the company name is the same as the owner’s or owners’ name(s). For example, John Smith is operating a landscaping business as a sole proprietorship. In order to transact business as Smith’s Landscaping, he must file a DBA for that name. Otherwise, he must transact business as John Smith.

A corporation or LLC can also file a DBA to transact business under a name different from the one registered with the state (when the business was incorporated). For example, a corporation formed as Smith and Sons, Inc. may want to do business under a name that more clearly states what the company does and could file a DBA to use a more descriptive name like Smith Landscaping.

ADVANTAGES & LIMITATIONS

• For sole proprietorships and general partnerships, the advantage of filing a DBA is that it does not provide the same ongoing compliance requirements of incorporating or forming an LLC. It merely allows the company to transact business with the new name. The limitation is that it does not provide the liability protection and tax advantages of incorporating.

• A DBA filing does not change the official name of the corporation or LLC. It only allows the business to use a different name in trade, which can be in addition to or instead of the official corporate or LLC name.

Another business type that is formed under state law and gives you personal liability protection is the LLC. Tax-wise, an LLC is similar to an S corporation (or S corp), with business income and expenses reported on your personal tax return. If you are the only owner of an LLC, you are viewed as a “disregarded” entity. This means you report the LLC’s income and expenses on Schedule C of Form 1040─the same schedule used by sole proprietors.An LLC might be the right type of business for you if:

• Your startup company anticipates losses for at least two years and you want to be able to pass the losses through to yourself and the other owners

• Flexibility for accounting methods is desired, because LLCs are not required to use the accrual method of accounting as C corporations typically are

• Your business may own real estate

• You want management flexibility, since LLCs offer more flexibility than corporations in terms of how the management of the business is structured

•You wish to minimize ongoing formalities; unlike corporations, which are required to hold annual meetings of directors and shareholders and keep detailed documents and records for all corporate meetings and major business decisions, LLCs do not face strict ongoing meeting and documentation requirements

• You want flexibility for sharing profits among owners

C CORPORATION

S CORPORATION

A corporation is a separate legal entity set up under state law that protects owner (shareholder) assets from creditor claims. Incorporating your business automatically makes you a regular, or “C” corporation. A C corporation (or C corp) is a separate taxpayer, with income and expenses taxed to the corporation and not owners. If corporate profits are then distributed to owners as dividends, owners must pay personal income tax on the distribution, creating “double taxation” (profits are taxed first at the corporate level and again at the personal level as dividends). Many small businesses do not opt for C corporations because of this tax feature. A C corporation might be the right business type for you if you:

• May need venture capital for financing

• Want flexible profit-sharing among owners

• Want company earnings to stay in your business so that it can grow

• Want flexibility to spread the business earnings between the corporation and shareholders for tax-planning purposes

• Want flexibility to set salaries for employees/owners to minimize Social Security and Medicare taxes

• Want flexibility to provide (through the corporation) substantial health and medical benefits and other fringe benefit programs for things like education, life insurance, and transportation costs

• Want to be able to easily sell your business

• Want to provide an accountable plan for travel & entertainment

• Want to be able to offer stock options to employees

• Expect your business to own real estate

• Prefer to lower your risk of IRS audit exposure, since there is a higher audit rate for business income that is reported solely on Schedule C of Form 1040 (U.S. Individual Income Tax Return)

Once you’ve incorporated, you can elect S corporation status by filing a form with the IRS and with your state, if applicable, so that profits, losses and other tax items pass through the corporation to you and are reported on your personal tax return (the S corporation does not pay tax). An S corporation might be the right business type for you if:

• You want to take advantage of benefits that the corporate business type holds, but you want to take advantage of pass-through taxation

• You want flexibility to set salaries for employee/owners to minimize Social Security and Medicare taxes

• Flexibility of accounting methods is desired, because corporations must use the accrual method of accounting unless they are considered to be a small corporation (with gross receipts of $5,000,000 or less) and S corporations typically don’t have to use the accrual method unless they have inventory

• Lower risk of IRS audit exposure is desired, because S corporations file an informational tax return (Form 1120 S U.S. Income Tax Return for an S Corporation) and there is a higher audit rate for business income that is reported solely on Schedule C of Form 1040 (U.S. Individual Income Tax Return)

SERVICES

ANALYTICS AUDIT

CRM | CUSTOMER RELATIONSHIP MANAGEMENT

CONSULTING

COPYWRITING

DIGITAL MARKETING

DOMAIN NAMES

E-COMMERCE

E-MAIL MARKETING

FACEBOOK ADVERTISING

GOOGLE ADS | SEM

GRAPHIC DESIGN

INCORPORATION

INFORMATION TECHNOLOGY

INSTAGRAM ADVERTISING

LANDING PAGES

LOGO DESIGN

PHONE SYSTEMS

PHOTOGRAPHY

PUBLIC RELATIONS

SEO AUDIT

SOCIAL MEDIA AUDIT

STARUP BUSINESS SERVICES

VIDEO PRODUCTION

WEB DESIGN

WEBSITE MAINTENANCE

ADVANTAGES OF INCORPORATING

• Owners are protected from personal liability fro company debts and obligations.

• Corporations have a reliable body of legal precedent to guide owners and managers.

• Corporations are the best vehicle for eventual public companies.

• Corporations can more easily raise capital through the sale of securities.

• Corporations can easily transfer ownership through the transfer of securities.

• Corporations can have an unlimited life.

• Corporations can create tax benefits under certain circumstances, but note that C corporations may be subject to “double taxation” on profits. To avoid this, many business owners elect to operate their corporations under subchapter S of the Internal Code. Also known as an S corporation, this entity allows income to pass through to the individual shareholders.

UNDERSTANDING CORPORATION TYPES

FILING A DBA

A DBA filing (doing business as, also called an assumed or fictitious business name) allows a company to transact business using a different name. It generally takes place at the county level, but some states have state-level DBA filings. For sole proprietorships and general partnerships, unless a DBA is filed, the company name is the same as the owner’s or owners’ name(s). For example, John Smith is operating a landscaping business as a sole proprietorship. In order to transact business as Smith’s Landscaping, he must file a DBA for that name. Otherwise, he must transact business as John Smith.

A corporation or LLC can also file a DBA to transact business under a name different from the one registered with the state (when the business was incorporated). For example, a corporation formed as Smith and Sons, Inc. may want to do business under a name that more clearly states what the company does and could file a DBA to use a more descriptive name like Smith Landscaping.

ADVANTAGES & LIMITATIONS

• For sole proprietorships and general partnerships, the advantage of filing a DBA is that it does not provide the same ongoing compliance requirements of incorporating or forming an LLC. It merely allows the company to transact business with the new name. The limitation is that it does not provide the liability protection and tax advantages of incorporating.

• A DBA filing does not change the official name of the corporation or LLC. It only allows the business to use a different name in trade, which can be in addition to or instead of the official corporate or LLC name.

LIMITED LIABILITY COMPANY (LLC)

Another business type that is formed under state law and gives you personal liability protection is the LLC. Tax-wise, an LLC is similar to an S corporation (or S corp), with business income and expenses reported on your personal tax return. If you are the only owner of an LLC, you are viewed as a “disregarded” entity. This means you report the LLC’s income and expenses on Schedule C of Form 1040─the same schedule used by sole proprietors.An LLC might be the right type of business for you if:

• Your startup company anticipates losses for at least two years and you want to be able to pass the losses through to yourself and the other owners

• Flexibility for accounting methods is desired, because LLCs are not required to use the accrual method of accounting as C corporations typically are

• Your business may own real estate

• You want management flexibility, since LLCs offer more flexibility than corporations in terms of how the management of the business is structured

•You wish to minimize ongoing formalities; unlike corporations, which are required to hold annual meetings of directors and shareholders and keep detailed documents and records for all corporate meetings and major business decisions, LLCs do not face strict ongoing meeting and documentation requirements

• You want flexibility for sharing profits among owners

C CORPORATION

A corporation is a separate legal entity set up under state law that protects owner (shareholder) assets from creditor claims. Incorporating your business automatically makes you a regular, or “C” corporation. A C corporation (or C corp) is a separate taxpayer, with income and expenses taxed to the corporation and not owners. If corporate profits are then distributed to owners as dividends, owners must pay personal income tax on the distribution, creating “double taxation” (profits are taxed first at the corporate level and again at the personal level as dividends). Many small businesses do not opt for C corporations because of this tax feature. A C corporation might be the right business type for you if you:

• May need venture capital for financing

• Want flexible profit-sharing among owners

• Want company earnings to stay in your business so that it can grow

• Want flexibility to spread the business earnings between the corporation and shareholders for tax-planning purposes

• Want flexibility to set salaries for employees/owners to minimize Social Security and Medicare taxes

• Want flexibility to provide (through the corporation) substantial health and medical benefits and other fringe benefit programs for things like education, life insurance, and transportation costs

• Want to be able to easily sell your business

• Want to provide an accountable plan for travel & entertainment

• Want to be able to offer stock options to employees

• Expect your business to own real estate

• Prefer to lower your risk of IRS audit exposure, since there is a higher audit rate for business income that is reported solely on Schedule C of Form 1040 (U.S. Individual Income Tax Return)

S CORPORATION

Once you’ve incorporated, you can elect S corporation status by filing a form with the IRS and with your state, if applicable, so that profits, losses and other tax items pass through the corporation to you and are reported on your personal tax return (the S corporation does not pay tax). An S corporation might be the right business type for you if:

• You want to take advantage of benefits that the corporate business type holds, but you want to take advantage of pass-through taxation

• You want flexibility to set salaries for employee/owners to minimize Social Security and Medicare taxes

• Flexibility of accounting methods is desired, because corporations must use the accrual method of accounting unless they are considered to be a small corporation (with gross receipts of $5,000,000 or less) and S corporations typically don’t have to use the accrual method unless they have inventory

• Lower risk of IRS audit exposure is desired, because S corporations file an informational tax return (Form 1120 S U.S. Income Tax Return for an S Corporation) and there is a higher audit rate for business income that is reported solely on Schedule C of Form 1040 (U.S. Individual Income Tax Return)

WHY INCORPORATE?

It is true that operating as a corporation has its share of drawbacks in certain situations. For example, as a business owner, you would be responsible for additional record keeping requirements and administrative details. More important, in some cases, operating as a corporation can create an additional tax burden. This is the last thing a business owner needs, especially in the early stages of operation. Remember, aside from tax reasons, the most common motivation for incurring the cost of setting up a corporation is the recognition that the shareholder is not legally liable for the actions of the corporation. This is because the corporation has its own separate existence wholly apart from those who run it. However, let’s examine three other reasons why the corporation proves to be an attractive vehicle for carrying on a business.

• Unlimited life. Unlike proprietorship’s and partnerships, the life of the corporation is not dependent on the life of a particular individual or individuals. It can continue indefinitely until it accomplishes its objective, merges with another business, or goes bankrupt. Unless stated otherwise, it could go on indefinitely.

• Transferability of shares. It is always nice to know that the ownership interest you have in a business can be readily sold, transferred, or given away to another family member. The process of divesting yourself of ownership in proprietorship’s and partnerships can be cumbersome and costly. Property has to be retitled, new deeds drawn, and other administrative steps taken any time the slightest change of ownership occurs. With corporations, all of the individual owners’ rights and privileges are represented by the shares of stock they hold. The key to a quick and efficient transfer of ownership of the business is found on the back of each stock certificate, where there is usually a place indicated for the shareholder to endorse and sign over any shares that are to be sold or otherwise disposed of.

• Ability to raise investment capital. It is usually much easier to attract new investors into a corporate entity because of limited liability and the easy transferability of shares. Shares of stock can be transferred directly to new investors, or when larger offerings to the public are involved, the services of brokerage firms and stock exchanges are called upon.

RELATED SERVICES

DOMAIN NAME

REGISTRATION

SBP will help you finalize your domain name(s), set up your business email, and advise you on your new website.

CONSULTING

We'll help you think more critically about your business, boost growth and operate more efficiently.

STARTUP BUSINESS

PACKAGES

SBP offers a suite of services to aspiring entrepreneurs looking to get their businesses off of the ground

DIGITAL

MARKETING

SBP will establish a multi-dimensonal marketing strategy that will drive more traffic.

RELATED SERVICES

DOMAIN NAME

REGISTRATION

SBP will help you finalize your domain name(s), set up your business email, and advise you on your new website.

CONSULTING

We'll help you think more critically about your business, boost growth and operate more efficiently.

STARTUP BUSINESS

PACKAGES

SBP offers a suite of services to aspiring entrepreneurs looking to get their businesses off of the ground

CONSULTING

SBP will establish a multi-dimensonal marketing strategy that will drive more traffic.

SBP TAKES YOU FROM DREAMER, TO DOER

Contacting us is the best way to get your new business up and running and partnered with other businesses in the South Bay. Fill out the form below or give us a call to Incorporate your business.

HOW BRAND IDENTITY IS DEFINED

Aug 13, 2019

All the components related to a product, service, company, or person is “brand identity.” Some of these items are the name, logo, tone, tagline, typeface, and shape that create an appeal. Brand identity is a separate category from brand image.

THE VIRTUAL MARKETPLACE IS RESHAPING RETAIL

Jul 23, 2019

Unlike e-commerce sites that involve businesses selling their own products through a website, virtual marketplaces are where third-party sellers can do business. Amazon and eBay are popular examples of virtual marketplaces. Also known as e-commerce marketplaces, such sites may feature individual traders, large-scale manufacturers of goods, or anything in between.

WELL BUILDING STANDARD – THE NEXT BIG THING IN BUSINESS

Jul 19, 2019

Our world is getting greener by the day. As a global community, we are trying vigorously to recycle more, waste less, and become more efficient in everything that we do. Now, with the green building trend towards sustainability firmly in place, the WELL Building Standard is helping to spearhead the next big wave of change – making buildings healthier and greener for those of us who inhabit them.

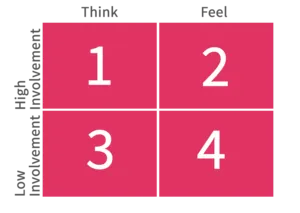

CRAFTING YOUR CONTENT STRATEGY TO CREATE USEFUL CONTENT

Jul 15, 2019

Not all content types work for all audiences. For example, the content strategy for a B2B could be to create content that requires a considered decision, whereas content for a B2C may be to stimulate an impulse buy. In this case, the B2B content should focus on establishing an authoritative profile for that business and providing more educational resources (quadrant 1). B2C content, on the other hand, should target users with emotion (quadrant 4). This was put best by Richard Vaughn and his FCB grid(3).

LETS GET STARTED

READY TO START A PROJECT OR REALLY CURIOUS ABOUT WHAT WE CAN DO FOR YOU? DROP US A

NOTE OR GIVE US A CALL (213) 444-2413; WE LOVE ANSWERING QUESTIONS AND BRAINSTORMING IDEAS!

HOME | SERVICES | COMPANY | KNOWLEDGE BASE | CONTACT US | CAREERS

CALL US: (213) 444-2413

©2009-2022 Holding Company: The South Bay Project, Inc. | Meta CMO™ | Meta Ads, LLC | Site design by us.